Tax season has already begun, and so did tax season scams. The IRS annually lists its top tax scams to help taxpayers protect themselves. Most tax season scams involve identity theft, but there could be a lot of other consequences. Awareness of these schemes can help consumers protect themselves, and we will go into more detail about that now.

Tax Season Scams

Tax season began on Jan. 29, when the Internal Revenue Service (IRS) started receiving and processing 2023 federal income tax returns. Simultaneously, this date acts as a wave-off to frauds, who start bombing people with fake emails and texts. The IRS expects over 146 million individual tax returns to be filed this season, with April 15 being a deadline. Since during this time a whole lot of personal information is exchanged, it becomes rather easy for con artists to access sensitive data. It includes Social Security numbers and other sensitive details that can be used to create convincing tax returns, collect refunds, or perpetrate other types of fraud.

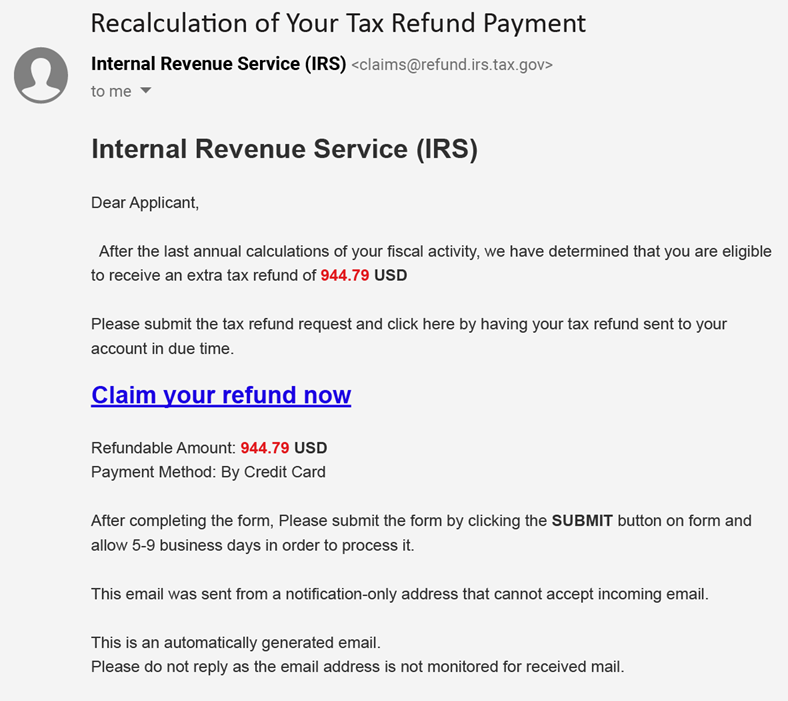

The IRS has warned that tax-related phishing and unsolicited texts have become increasingly common and even reached the top of the annual scams list. Some scammers may even use the IRS logo in phishing attempts to trick people into providing sensitive information, claiming that their account has been suspended or needs urgent action. It is essential to understand that The IRS doesn’t initiate contact with taxpayers by email, text messages, or social media to request personal or financial information. Next, let’s look at the most common types of tax scams.

Tax Season-Related Phishing

Phishing is the most effective modus operandi for frauds who hunt for personal data. They send emails and text messages en masse to steal confidential information. Since tax season-themed emails are expected, the chances of a successful scam are high – the victim will not suspect a fraud. Before calling the listed phone number, clicking on a link, or opening a file, we recommend going to the organization’s official website in your browser by manually entering the address, and double-checking the information.

Another trait of fraud is a sense of urgency and threat. Scammers sometimes reach people on the phone, pretending to be a collection agency, law enforcement, or the Bureau of Tax Enforcement. They may claim that your social security number has been canceled, the identity of yours has been stolen and you urgently need to contact them. They may also threaten to arrest you if you don’t call back. In such cases, the best option is to disconnect the call.

Alternatively to threats or urgency, frauds can try gaining your trust. Let me unfold this in more detail in the next paragraph.

Social Engineering Tricks

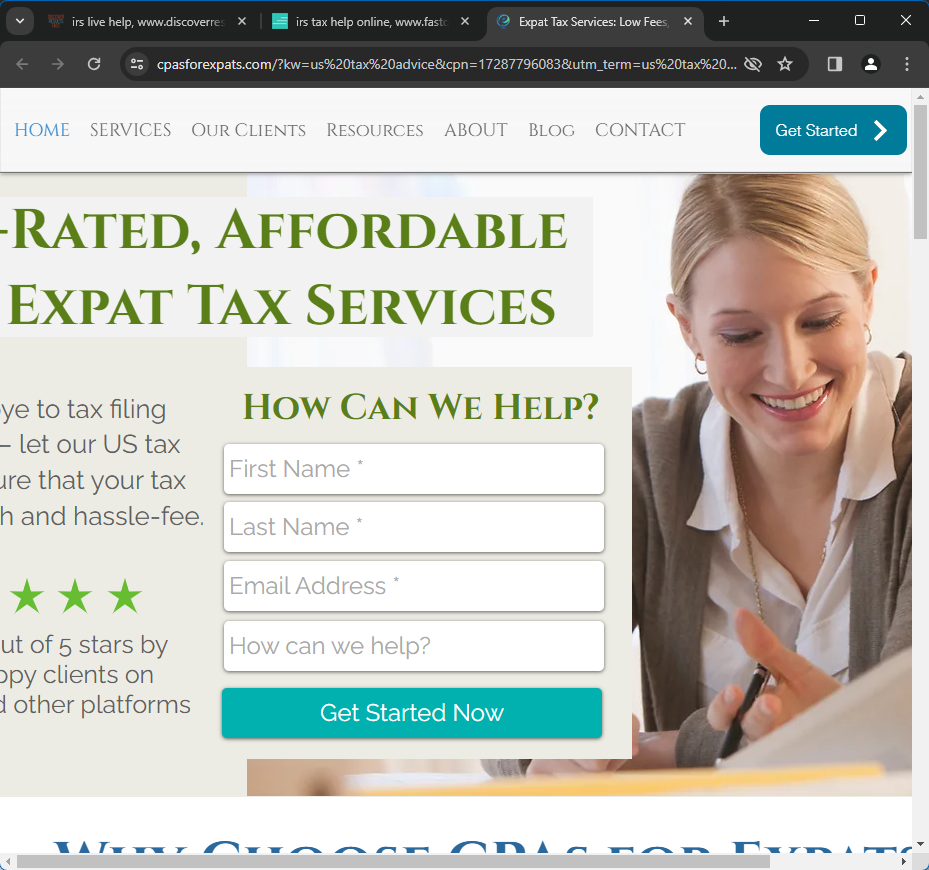

For the filing season, taxpayers may be cautious of anyone trying to help them set up an account. An IRS online account can give a lot of valuable information, including a payment history or a tax transcript. The system allows you to sign up for and manage an IRS payment plan. So, scammers may attempt to steal personal information like Social Security numbers, tax identification numbers, or photo IDs under the guise of helpfulness. Setting up an online IRS account is free, and if you require assistance, it is recommended that you work directly with the IRS representatives, to avoid any potential scams.

At the same time, some scammers may promise to sign your declaration while taking your money and not doing anything. According to the law, anyone paid to prepare or assist in preparing federal tax returns must have a valid Preparer Tax Identification Number (PTIN). Paid preparers must sign the return and include their PTIN on it. Failure to sign the return is a warning sign that the paid preparer may be looking to make a quick profit by promising a large refund or charging fees based on the size of the refund. Such muddy waters are a perfect place for different scams, both ones that include data leaks and money loss.

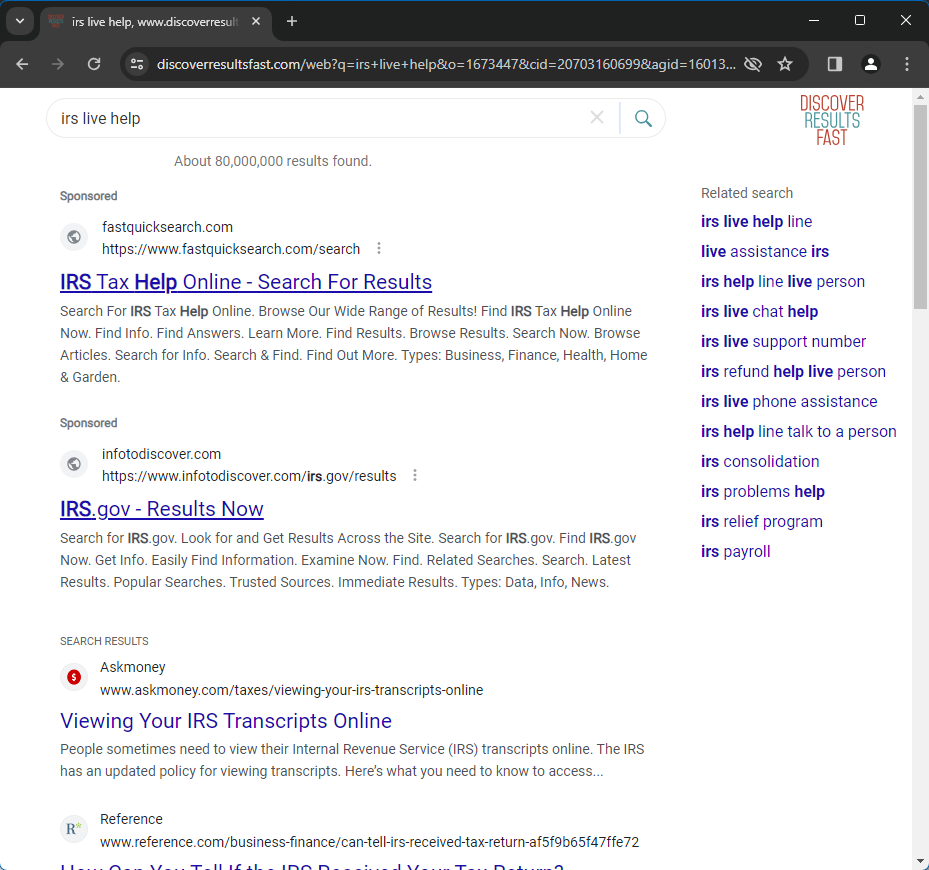

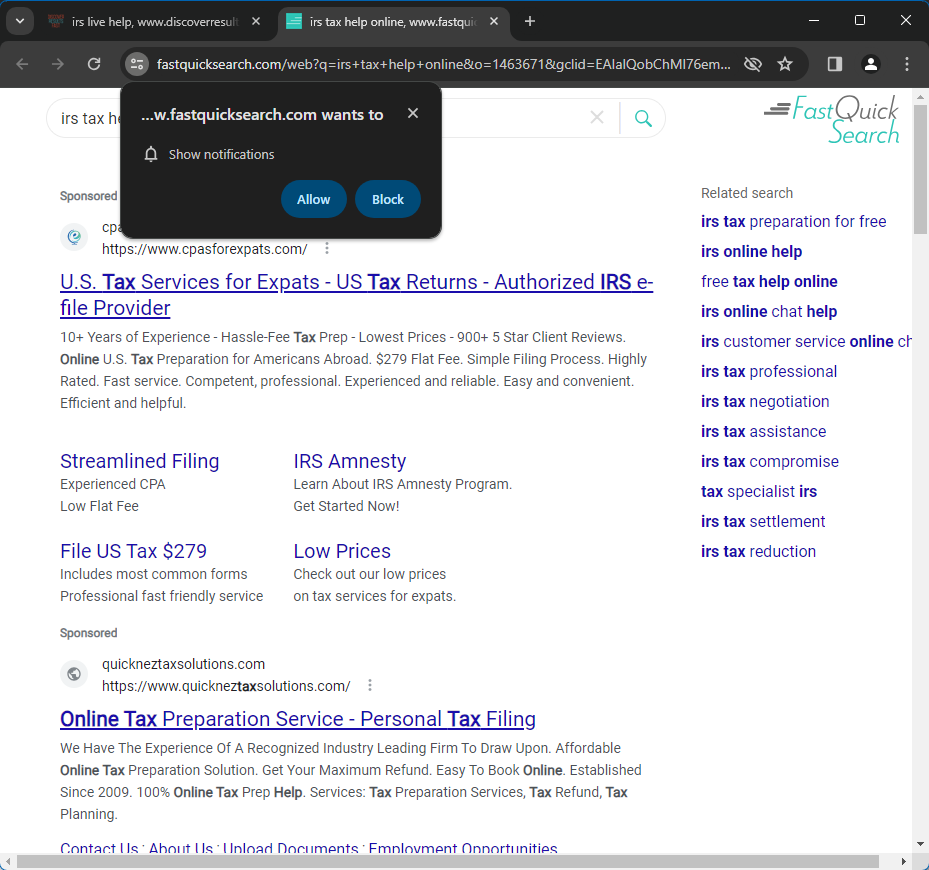

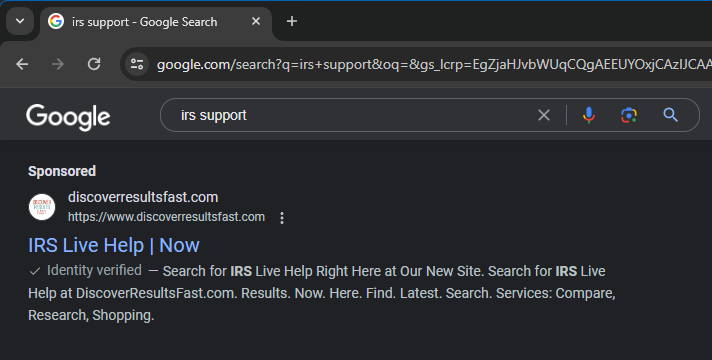

Malicious Google Ads

Upon facing any problems during the tax preparation, users often go to Google and look for the information. Fraudsters know this and buy search ads in advance to appear at the top of the results and look more convincing. The advertised sites may have different addresses and phone numbers but have nothing to do with legitimate services. Moreover, despite the differences, these sites usually look identical because they use the same template. Unfortunately, Google struggles with weeding out such promotions, so scoundrels manage to get their bite off the taxpayers, albeit for a rather short amount of time.

Some sites have an address visually identical to the legitimate one. However, if you examine it more closely, one or two characters often differ in the address of the fake site. This creates a visual similarity and sometimes allows you to bypass advertising moderation. In addition, such sites claim to have been on the market for many years. Though a simple website scanning on a service like Whois reveals that the site was created only a year ago.

Safety Recommendations

To summarize, the first and most important recommendation is to be vigilant and pay attention to each of your steps. The Internal Revenue Service’s official website is https://www.irs.gov/ and no other. Any help with tax payments should be done by authorized people, who sign their action with PTIN. Please read the information carefully. especially the fine print. If you doubt the reliability of the website, use our website reputation checker, which shows data from Whois and a verdict regarding the site’s status. Before calling a phone number, Google that number and find information about it. You can also use special services to identify the number.

One more piece of advice is using proper security tools. I recommend using Gridinsoft Anti-Malware and special ad blockers. The ad blocker will remove search ads, and Gridinsoft Anti-Malware will be able to block malicious and suspicious sites with its Online Security module. Using this combination and the recommendations from the previous paragraph, you will maximize the security of your online activity.