During a time of crisis, Americans turned to digital wallets called eWallets to purchase supplies without face-to-face interaction with payment terminals or cards. These wallets make purchasing supplies faster and easier than traditional methods. A common alternative to eWallets is the physical wallet, which is less convenient for many people. In addition, clever crooks and hackers can steal your financial information when using an eWallet. This is because they’ve discovered an opportunity with eWallets that people only sometimes see. With a secure eWallet, you can feel more confident in your safety and security.

Even so, many people need to realize the benefits of using an eWallet. After reading this article, you can take steps to keep your wallet safe. These include using online secure software and common sense practices.

What are eWallets? What are the benefits?

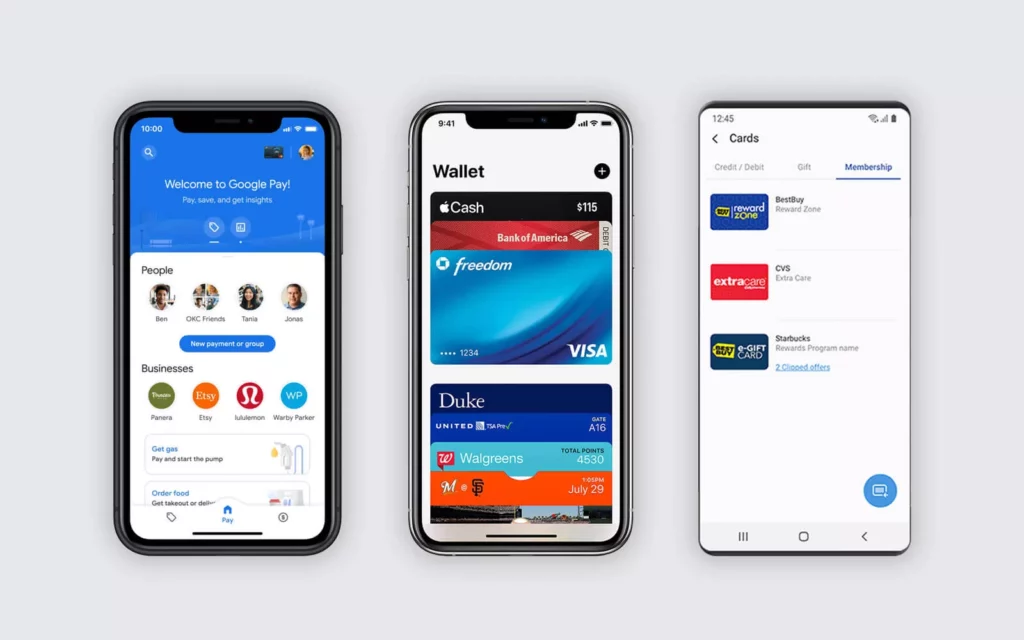

Electronic wallets are similar to credit or debit cards. They enable individuals to make payments online through a computer or smartphone — for example, E-wallets link to a person’s bank account to be used for payments. A software component and an information component make up e-wallet functionality. The software component stores encrypted and secure data, while the information component stores data provided by the user.

The data used by such programs is the user’s name, address, payment method, and amount to be paid. If applicable, it also has data on the user’s credit or debit card. When setting up an E-wallet account, a person needs to install the software on their device. They then need to enter information to set up the E-wallet. After shopping online, the E-wallet automatically fills in the user’s info when submitting a payment form. Users can activate the E-wallet by entering their password. After the online payment is completed, the consumer does not need to fill out the order on any other website, as the information is stored in the database and updated automatically.

Common threats associated with eWallets

Consumers need to be aware of the security risks associated with digital wallets. Many threat actors have noticed digital wallets’ popularity and made their best to get profit from this situation. Using eWallets to secure data is the most common way to mitigate threats to data. Avoid public WiFi when possible so your personal data remains private. Users should lock their phones or digital wallets — thieves can remove information and make purchases quickly. The biggest threat to your phone is someone else stealing or breaking it. When your phone’s missing, thieves and burglars can access your bank account and withdraw money before you even notice.

How to protect your eWallet and avoid these issues

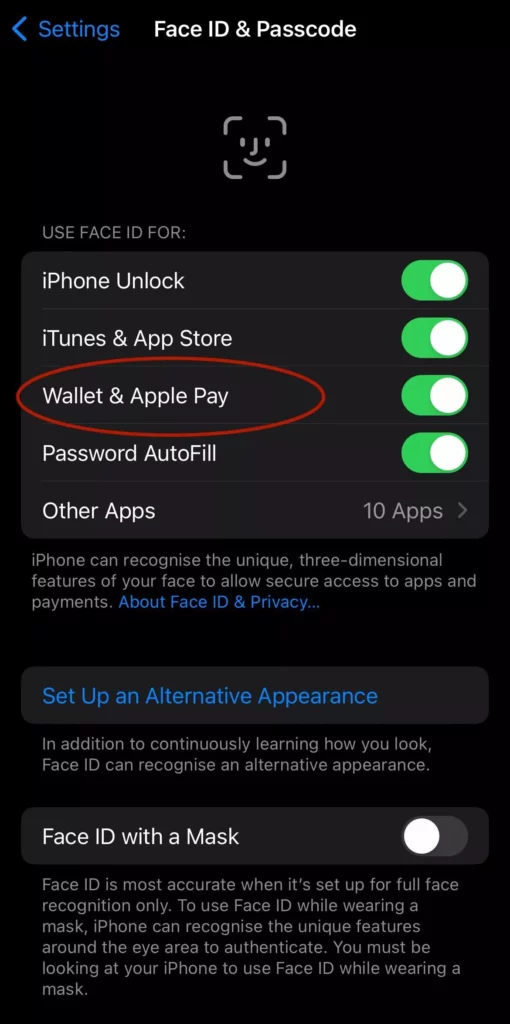

1. Lock your phone

The most significant risk of using an e-wallet is failing to protect your phone’s data. Use the provided secure options to lock your phone and perform the same operation on your electronic wallet and other essential applications containing private data. In this way, the thief cannot access your mobile phone or electronic wallet.

2. Monitor credit card and bank account activity

Constantly monitor your financial activity and understand your expenses. If you notice suspicious charges, you must contact your bank immediately and freeze your financial account.

3. Install secure apps

If you have to deal sensitive financial information, such as the one typically present in electronic wallet, you should protect it as much as possible. Install secure apps that are secure from being hacked. Additionally, ensure that the exact app is legitimate, and will not steal your banking data one day. The ability to remotely delete it is also helpful if you’ve lost your device and don’t want someone to get their hands on your payment details.

4. Check the sites you use eWallet on

Not each site that accept e-wallet payments is trustworthy. Aside from phishing scam sites, there are enough pages that can take your money and give nothing instead. Most of anti-malware solutions tracks these sites, but it is also recommended to stay vigilant. If the offer looks too good to be true, or there are some strange payment conditions – it is better to look for another marketplace.