OfferUp has become a new vector for marketplace scams, despite the platform not being freshly minted. As the way users interact in this service differs from more common places like Amazon or eBay, the way fraudsters approach people and trick them into dirty schemes is also different. In this post, I will explain all the aspects of OfferUp scams and show how to recognize them before any interactions.

OfferUp Scams on the Rise

Despite all the modern security measures implemented on the platform, there are no fewer users who have fallen victim to OfferUp scams compared to fraudulent activities on other platforms. While I have no doubt about OfferUp’s legitimacy as a trading platform, the human factor remains the weakest link. Attackers find ways to bypass the protections and deceive users using both new and trivial old tricks. The effectiveness of OfferUp scams is highlighted by the Better Business Bureau (BBB), which reports that online shopping fraud represents 30% of all reports on its ScamTracker site, with 71% of victims experiencing financial loss.

Top Common OfferUp Scams

Let’s now take a closer look at the most popular OfferUp scams and how they work. As mentioned earlier, most of them exploit human vulnerabilities, mainly through social engineering techniques.

1. Phishing

Old yet stunningly effective. Phishing has existed nearly as long as users interact on the Internet and remains a persistent threat. In this case, scammers create fake websites mimicking OfferUp, sending emails or messages that appear to be from the platform with malicious links. Sometimes they pretend to be support representatives, contacting the victim via SMS or email. Typically, fraudsters claim there is an issue with the victim’s account, prompting them to click a link and follow specific instructions to “resolve” it.

The primary goal of these scams is to access the victim’s account, and obtain the underlying confidential data, including personal and payment information. Once obtained, attackers can either drain the victim’s bank accounts or sell the stolen data on illicit markets.

2. Empty Box Scams

Though not immediately obvious, this is a fairly common scam, not just on OfferUp but across many online marketplaces. This scam gained traction during the GPU shortage of 2020-2021. The essence of fraud lies in the trickery and lies on the part of the seller, in the photo and description of the product. During the GPU price surge, scammers exploited the demand by selling empty graphics card boxes. Sometimes these boxes were sold at prices below market value, while others could match regular prices.

When buyers purchased things from these listings, they would receive an empty graphics card box. Some scammers took a more creative approach by placing a printed photo of the graphics card inside the box. Technically, the graphics card was “included” – but only as a photo. Over time, such cunning scammers were banned from platforms for violating policies, but they adapted. Later, they started to hide terms in the product description, mentioning that they were selling only the box or, in fine print, “a photo of the product”. Technically, they weren’t breaking any rules, but an unwary buyer could easily overlook this detail.

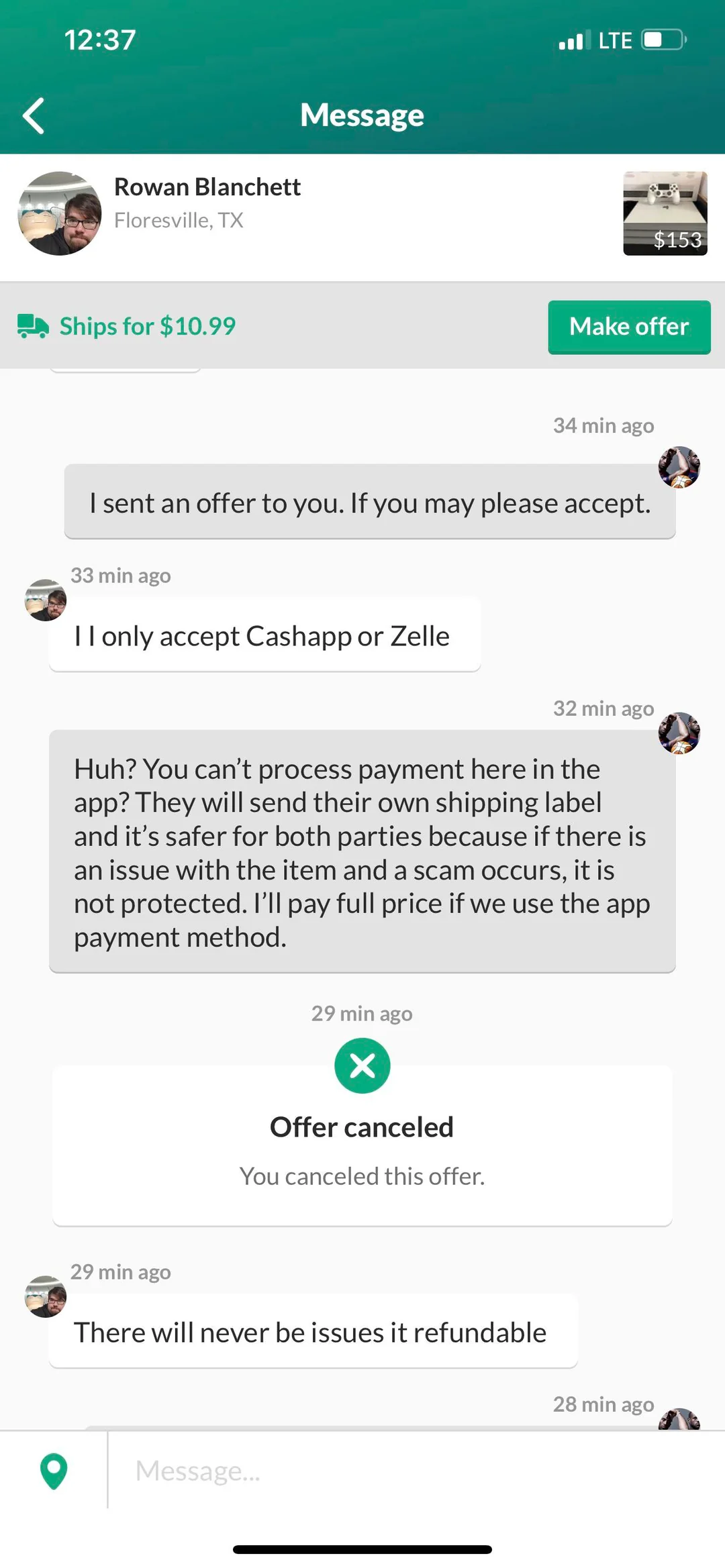

3. Ask for payment outside the app

Like many online marketplaces, OfferUp features an integrated payment system. In simple terms, when a user purchases an item, the platform holds the buyer’s payment in escrow. When the buyer receives the product and confirms satisfaction in the app, the payment is released to the seller. If the buyer rejects the item, the money is refunded. All these transactions are monitored, allowing OfferUp to intervene in cases of fraud, whether from the seller or the buyer.

The core of this scam involves persuading the victim to make payments outside the app. Frauds who operate OfferUp scams often request payment through gift cards or third-party apps like Venmo, Cash App, PayPal, or Zelle. These payment ways make money chargebacks or any other forms of returns very difficult, if not impossible. The same applies to payments made in person. If a seller suggests using a personal check during a meetup, one should decline and cut the communication immediately. Always insist on paying in cash or through the app, as checks can be forged. And, obviously, it is better to meet the seller in a public, well-populated area – just for the sake of safety.

4. Overpayment Scams

Overpayment schemes are another common tactic of OfferUp scams to be aware of. These tricks frequently occur on other platforms, like Facebook Marketplace or eBay, and often target sellers. A key aspect of this scam involves using third-party payment methods, as previously mentioned, but everything works in a reverse order.

The scammer “accidentally” overpays for the item and requests that the seller refund the difference. Once the seller returns the extra money, the scammer reverses their initial payment, leaving the seller out of pocket. Though not widespread and with potential failures, such a fraud keeps appearing regularly.

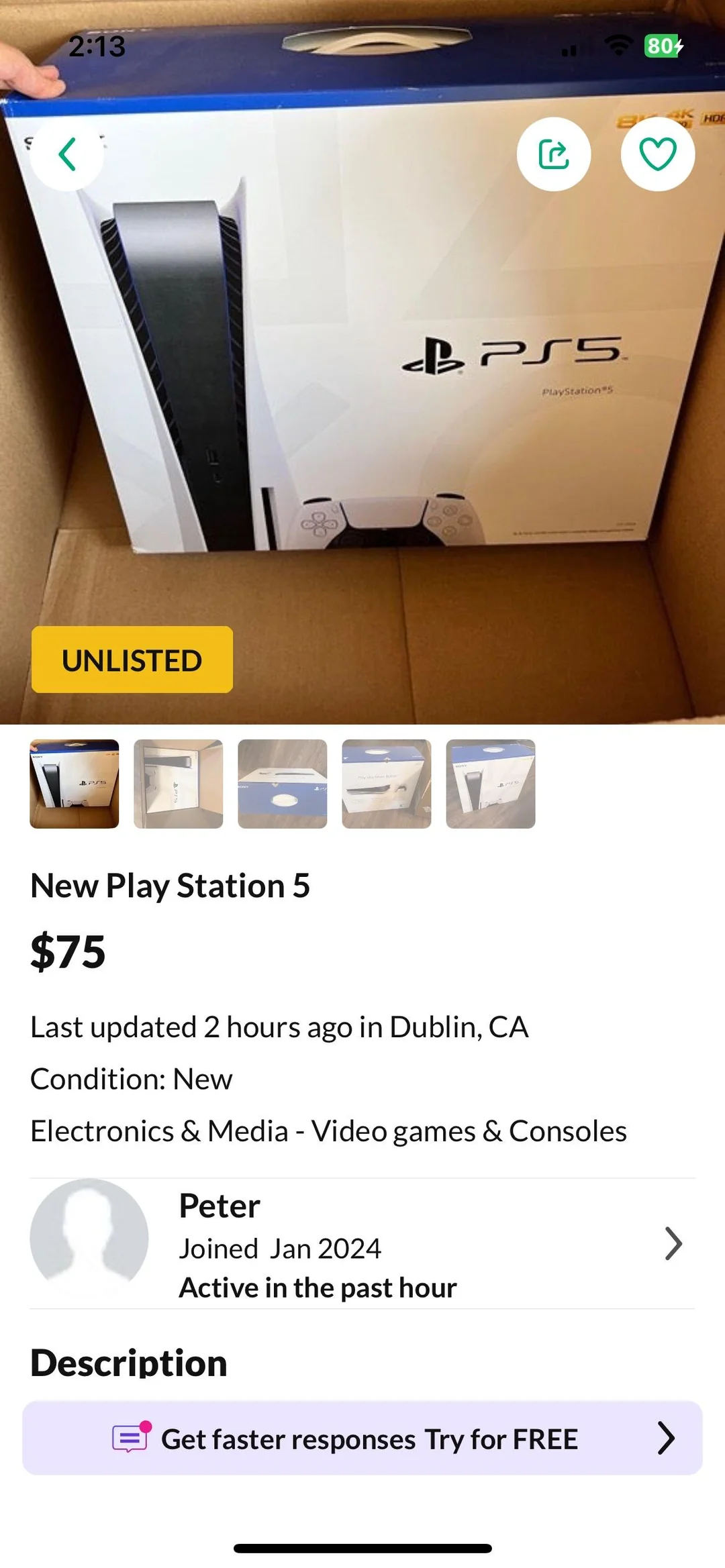

5. Price is too good

The exact opposite of the previous item and closest relative of the “must sell ASAP” scam is a price that is too low (usually, below the average market price). It’s rare for sellers to drastically underprice items out of generosity – such offers are almost always suspicious.

A price too good to be true often signals one of two things: a defective item or an outright rip-off. The outcome of such transactions is predictable: you could receive an empty box, one filled with junk, or a low-quality item from Temu/Alibaba.

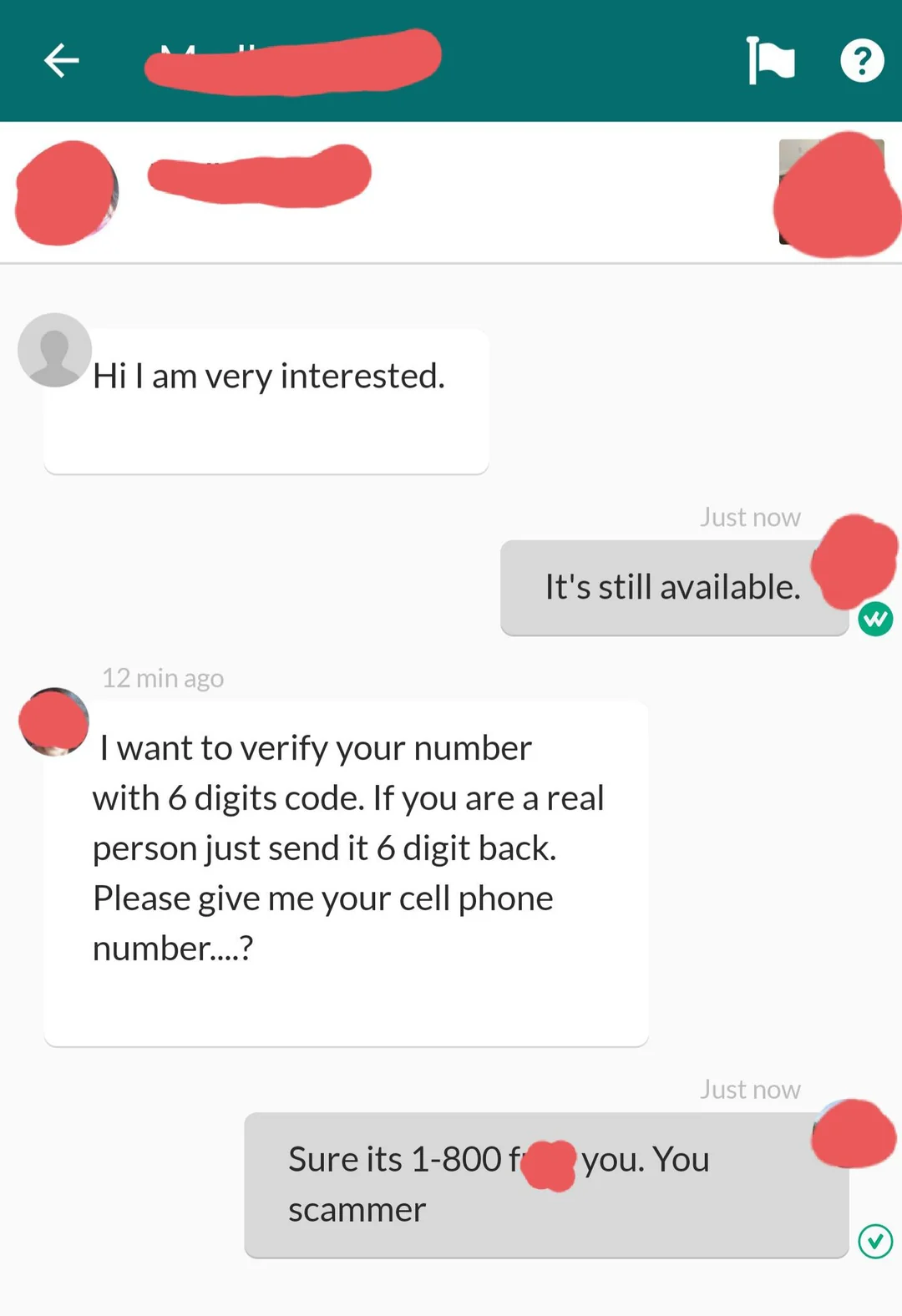

6. Request for a verification code

This scam may seem bizarre but is surprisingly effective. Scammers ask you to verify your identity using a code sent to your phone. They may claim it’s “for security purposes” or “to complete a transaction”. In reality, this is a classic account hijacking attempt, with the scammer using the code to gain access to your account. At best, the victim loses access to their account. At worst, the attacker uses the account to impersonate the victim, scamming friends, customers or using the credit card to pay for their own purchases. That is how the classic phishing looks like.

How To Stay Safe?

Now that we know how it all works, let’s figure out how to avoid becoming a victim of OfferUp scams. First, be vigilant when web browsing: when it comes to phishing copies of genuine OfferUp websites, the fraudsters can be very inventive. Check the URL of the site and its certificate information: any discrepancies here indicate the scam attempt. But first and foremost, I would recommend you to avoid clicking on suspicious links in emails, SMS or elsewhere. This step alone will dramatically reduce the chance of getting to a phishing page.

If you are interested in the product, but the photos provided in the ad confuse you, do not hesitate to write to the seller and ask to send more photos. If the item is real and the seller is interested in selling, he will send a photo of the item. If the price is unusually low, ask the seller for the reason behind it.

Only communicate with the seller/buyer within the platform. If you are asked to go to private messenger messages or SMS, refuse and cut the conversation. The same goes for payment methods – use ONLY the payment methods provided by the platform or cash (no checks) in public places during face-to-face transactions. If you were paid an amount that exceeds the value of the goods, do not rush to send change. Wait for the customer to reverse the payment themselves – that is what the normal customer will do.

Stop any conversation with “verification code” guys. Sending codes to your devices never happens, neither on the buyer side nor on the seller one. Such a demand is a definite sign that something fishy happens in the background, and it is a bad idea to keep on ignoring this red flag.