Crypto recovery scams are a specific type of fraud targeting individuals who have already lost money in cryptocurrency scams. In these schemes, fraudsters pose as professional recovery agents, promising to help victims reclaim their funds. Instead, they charge fees comparable to the victim’s initial loss, effectively scamming them a second time.

Understanding Crypto Recovery Scams

While cryptocurrency hype may have cooled, related scams remain prevalent. Crypto recovery scams specifically target people already victimized by crypto fraud, exploiting their desperation to recover lost assets.

Statistics on Cryptocurrency Fraud Losses

Source: Federal Trade Commission (FTC), data for 2020-2023

Cryptocurrency can be lost due to various reasons, from technical issues like hardware wallet malfunctions to human error. However, scammers primarily target victims of fraudulent investment schemes rather than technical mishaps. We’ve previously covered various types of cryptocurrency fraud.

This article focuses specifically on “cryptocurrency recovery agencies” — fraudulent services that prey on people who have already been scammed, luring them into yet another deceptive trap. The rise of cryptocurrency scams on social media has made these secondary scams increasingly common in recent years.

Examples of Fraudulent Recovery Services

| Domain | Description | Registration Date | Status |

|---|---|---|---|

| Againstcon.com | Site masquerading as a crypto recovery service, likely fraudulent | 2023-02-09 | Active |

| Refund-it.info | Suspicious site offering services to recover lost funds from unregulated companies | 2025-02-26 | Active |

| Walletblockchain.net | Deceptive site offering fake solutions for recovering cryptocurrencies | 2024-07-17 | Active |

| Leeultimatehacker.com | Scam site promising to hack accounts to recover lost funds | 2024-04-05 | Active |

| Fiordintel.net | Phishing site pretending to be a service for tracking and recovering cryptocurrencies | 2025-02-21 | Active |

You can conduct your own investigation using our Inspector API by performing a search with the tag “Recovery Service” here.

How Crypto Recovery Scams Work

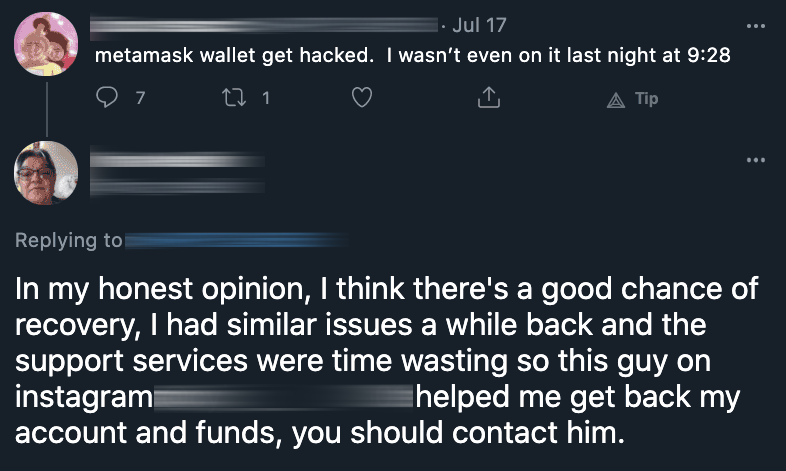

Victim Targeting Methods

- Social Media: Scammers search for victims in cryptocurrency investment groups and trading forums

- Fake Reviews: Posting comments from people who allegedly recovered their money through a “specialist”

- Direct Contact: Directly approaching victims in crypto communities offering help

- Dark Web: Selling lists of victims they’ve deceived or hacked to other scammers

After establishing contact with the victim, scammers immediately request extensive information. While this might seem logical since such an operation requires comprehensive victim data, scammers typically request information that would rarely be necessary — Social Security numbers, detailed personal information, and more.

Typical Scam Sequence

- Scammers demand an upfront payment for their services

- After receiving the initial payment, they often cut all communication

- In some cases, they simulate progress and request additional funds, claiming “extra resources are needed to solve the problem”

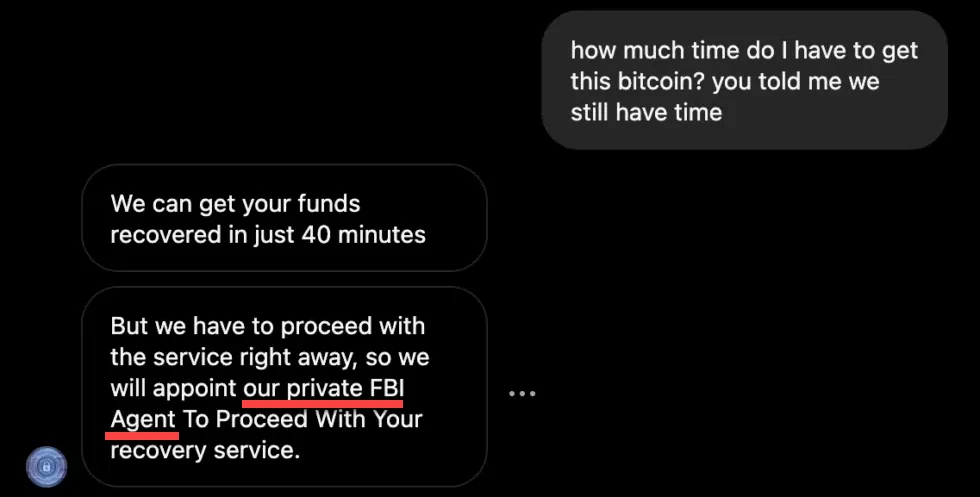

- Scammers employ various social engineering tactics, potentially resulting in multiple payment requests before they eventually stop responding to the victim

Warning Signs and Potential Risks

10 Red Flags of Crypto Recovery Scams

- Upfront Fee Requests. If someone asks for money before providing help, it’s likely a scam. They may initially request a small amount, then continuously demand more.

- Claims of “Special Access” to Crypto Exchanges. Scammers will claim to have special methods to recover your cryptocurrency. This is always false.

- Requests for Passphrase or Sensitive Information. If they want this information, they’re attempting to steal from you.

- Requests for Bank or Crypto Wallet Details. Scammers may ask for your wallet or bank information to “deposit” the recovered crypto. They simply want to steal more money.

- No Physical Address or Located Outside the U.S. If there’s no address or it’s outside the U.S., it may be fake. Many scam companies use fictional addresses.

- No Phone Number or Exclusive Use of Messaging Apps. Legitimate companies communicate by phone. Scammers use apps like Telegram or WhatsApp to hide.

- Guaranteed Fund Recovery. Legitimate services never guarantee cryptocurrency recovery as it’s often impossible.

- Creating Urgency. Scammers often create a sense that you must act immediately or lose your opportunity.

- Requests Not to Contact Law Enforcement. A strange demand from supposed “legitimate money recovery agents.”

- No Verifiable Reviews or Success History. If a company cannot provide genuine evidence of successful fund recovery, that’s a red flag.

Key Risks for Victims

| Risk | Impact | Probability |

|---|---|---|

| Financial Loss | High | Very High |

| Personal Data Exposure | High | High |

| Credential Theft | High | Medium |

| Repeat Victimization | Medium | High |

| Emotional Distress | Medium | High |

Such schemes involve serious risks. First, significant financial losses. Scammers typically demand large sums upfront, understanding that victims are desperate to recover their lost cryptocurrency. Second, there’s the risk of confidential information exposure. Attackers may request credit card information or online banking credentials, which they can use to empty victims’ accounts or resell on the Dark Web.

How to Protect Yourself from Recovery Scams

Preventive Measures

- Never trust services promising guaranteed cryptocurrency recovery

- Always verify the legitimacy of any company before providing personal information

- Contact law enforcement directly in case of fraud

- Use only verified cryptocurrency exchanges and wallets with good reputations

- Enable two-factor authentication on all your cryptocurrency accounts

- Regularly check your accounts for suspicious activity

- Be cautious about information you share on social media regarding your cryptocurrency investments

If You’ve Been Victimized

If you’ve fallen victim to a cryptocurrency recovery scam, here are several recommendations that may help:

- Report the incident to the platform’s support through which you were defrauded

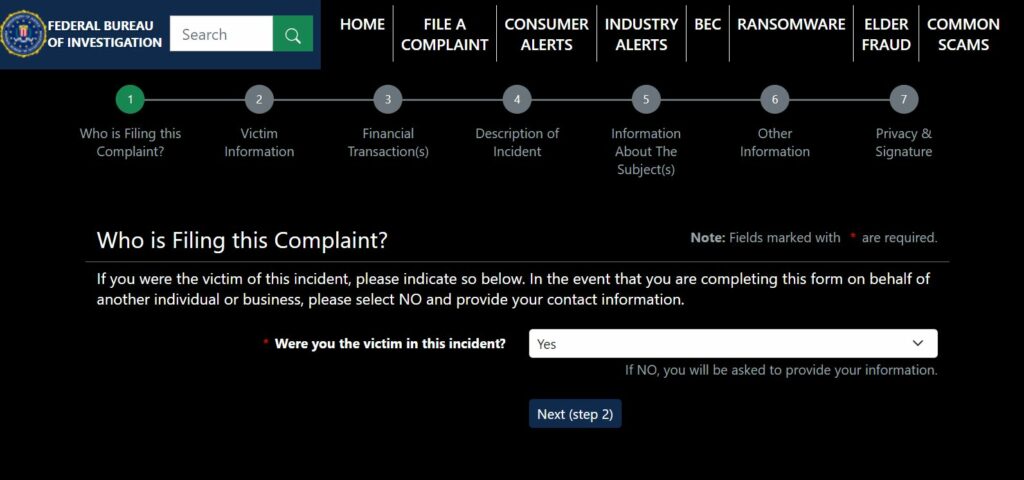

- File a report with law enforcement and gather as much evidence as possible

- Block access to your financial accounts and change passwords

- Preserve all correspondence with the scammers as evidence

- Report the fraud to appropriate regulatory authorities

Where to Report Cryptocurrency Scams:

- The Federal Trade Commission (FTC)

- The Commodity Futures Trading Commission (CFTC)

- The U.S. Securities and Exchange Commission (SEC)

- The FBI’s Internet Crime Complaint Center (IC3)

Legitimate Methods for Cryptocurrency Recovery

If you find an organization that helps recover lost funds, research their procedures, refund methods, and genuine user reviews online. The primary challenge is that recovering stolen cryptocurrency is extremely difficult.

Almost the only way to accomplish this is to collect as much evidence and information as possible, gather the necessary documentation, and submit it to law enforcement agencies. Law enforcement may contact the platform’s representatives. If it’s proven that the stolen cryptocurrency belongs to the victim, there’s a chance it will be returned. This is the only legitimate way to recover lost cryptocurrency.

Case Studies: Recovery Scam Variations

Investment Recovery Firms

These scammers claim to be specialized investment recovery firms with legal expertise. They often create professional-looking websites with fake testimonials and credentials. They charge an upfront “legal retainer” or “case processing fee” but deliver no actual services.

Ethical Hacker Services

These scammers pose as “ethical hackers” who can retrieve lost crypto through technical means. They claim to have special tools to access blockchain networks or reverse transactions – capabilities that don’t actually exist in blockchain technology. They typically request payment in cryptocurrency “to test the recovery system.”

Law Enforcement Impersonators

Some scammers impersonate FBI agents or other law enforcement officials, claiming they’ve found your stolen cryptocurrency and need a “processing fee” to release it. They may use spoofed email addresses or fake badges to appear legitimate.

Blockchain Analysis Services

These scammers claim to offer specialized blockchain analysis to track and recover lost funds. They provide fake analysis reports with technical jargon and request payment for “advanced tracking services” that never materialize.

Conclusion

Cryptocurrency recovery scams pose a particular danger as they target people who have already been victims of fraud. Awareness of warning signs and understanding how these schemes operate is your best defense. If you’ve lost cryptocurrency to fraud, always contact law enforcement rather than dubious “recovery services.” Remember, if an offer sounds too good to be true, it most likely is a scam.

For more information about other types of cryptocurrency scams, check our articles on celebrity cryptocurrency giveaway scams and other common fraud schemes.

Becareful how you give someone your cryto wallet address it very dangerous, i was once a victim someone hack into my wallet and access all my money i couldn’t be able to have access

Money or Crypto asset lost to Scammers are Recoverable, i was able to recover 180K worth of bitcoin i lost to an investment scam

Unfortunately, many fell victim to these scam platforms.

I tried to invest my savings into forex broker’s trade during Pandemic and ever since last year December have been trying to withdraw my savings and each time i try to withdraw i’m asked to pay for fees and Tax fees

I lost some cryptocurrency recently and it was very hard to get it back from the scammer

This has got to be one of my worst nightmare. I tried everything I could to get my money back but despite all of my efforts I was not able to get it out. I got tired of everything

I tried to withdraw money from my account for nearly three months, but they kept telling me it was “processing.” Seriously, how long does it take to process? There’s no trusting a company that holds onto your money, promises it’ll arrive shortly, and three months later, you’re still empty-handed. Yet, they kept trying to convince me to use more of their services and send them even more money.