Protect yourself from Cash App scams by knowing how to stay safe. While Cash App is generally secure and uses advanced encryption and fraud detection technologies, scammers are still trying to steal your money. Despite the risks, the Cash App is a convenient and fast way to transfer money and split expenses with family and friends.

But there are some dangers that few people know about. For example, money that users transfer through the Cash App (or similar apps) is not insured by the FDIC as if it were in your bank account. In this way, users may fall victim to fraud and not get their money back. and raising this issue of fraud, we would like to provide the top most common methods that fraudsters use when stealing your funds through the Cash App.

Top Latest Cash App Scams

Social engineering will always be necessary for fraudsters, which is why they produce the most successful attacks. Thousands of users are deceived and manipulated by intruders. Then they lose their confidential data and money. To do this, they need to gain trust in their victim, apply all their psychological techniques to her, seduce her, or lure her with a tempting prize. So what schemes are to be feared?

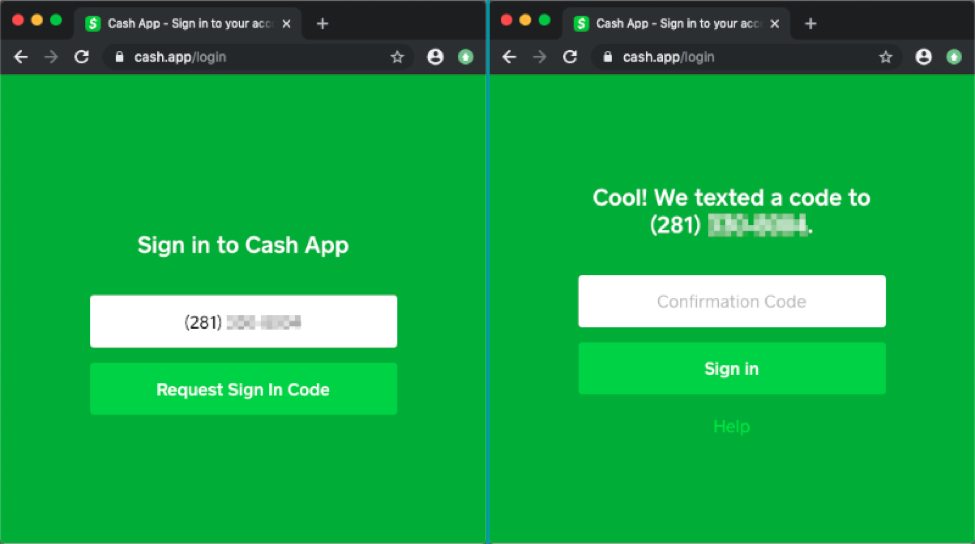

1. Phishing emails and fake websites that steal your cash app login details

Scammers often use phishing as a way to steal the information they need. This common method involves deception and disguising as a legitimate organization. Most phishing attacks occur via email, phone calls (vishing), and text messages (smishing). In case of fraud on Cash App, the fraudsters send a similar email address as in the app, which asks you to confirm your password or click on the link that will take you to the phishing site. Phishing is an unspoken pandemic causing a lot of trouble for individuals and corporations. Please remember that phishing is still the most common cyber attack.

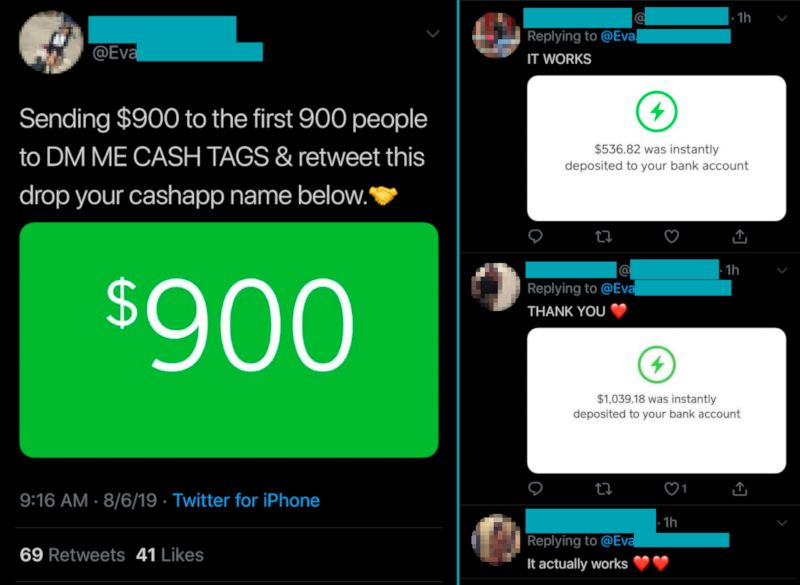

2. Cash “flipping” scams that promise significant returns for small investments

This method is gaining momentum in our time, as an investment in the high expected yield has become a common way to earn. But a crook could not have used it in his ill-intentioned ways. They promote their clever enrichment schemes on platforms like Instagram or Twitter. They confirm it with screenshots of the lucky ones who’ve already made a fortune. But to become a member of this happy coupon, the user needs to pay the initial amount, which in time, will bring income. Therefore, the attackers use the Cash App, as the money is transferred instantly and will not be returned.

3. Fake Cash App customer support websites and social media accounts

This method works because few users will believe what they hear from the support team on this platform. So again, they disguise themselves as a support team and ask you about your current balance or security questions. Unfortunately, there were also cases where fraudsters called clients and offered assistance with transferring funds to a bank account, and ultimately the money was in their hands.

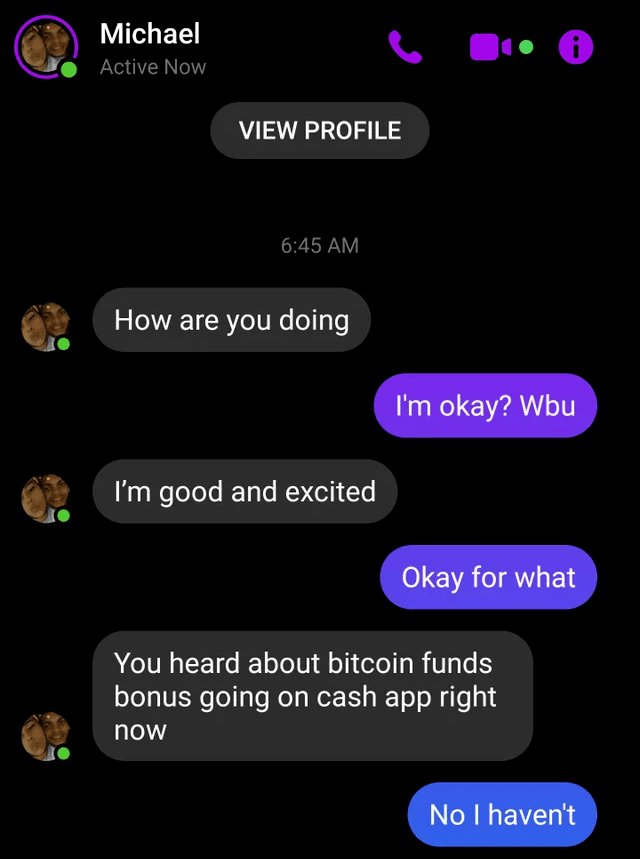

4. Cash App Cryptocurrency and Bitcoin Scams

Because cryptocurrency has become one of their primary earnings, fraudsters increasingly use scams in this area. In 2021 alone, more than a billion dollars in cryptocurrency were stolen through investment schemes. Here intruders place advertisements on different platforms of social networks about how someone was lucky to turn their small investments into a big profit. If users respond, scammers ask them to transfer money to Bitcoin through the Cash App to replenish their wallet and expect interest with gain.

5. CashAppFridays and SuperCashAppFriday giveaway scams

On Fridays, the Cash App team hands out free promotions through social media such as Twitter or Instagram. Users need to answer with their Cash App “$cashtag” to win this. However, be careful as the attacker creates fake accounts, grabs the hashtag, and responds to people who answer in the original branch of the app. In their messages, they claim you won the prize and will ask for your financial information to send prize money to your account.

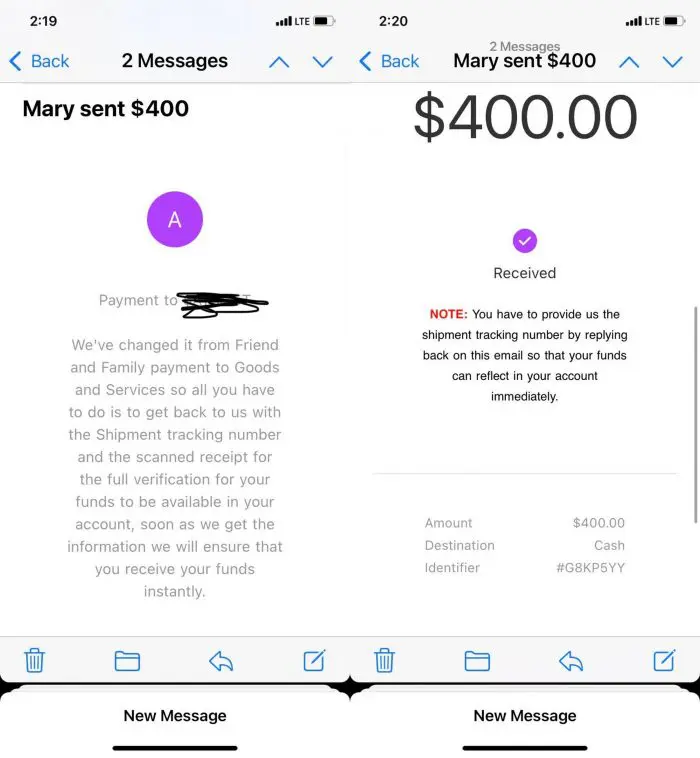

6. Fake Cash App payment notifications and emails

Cash App provides transactions between relatives and friends or with other people you know well. But there are also transfers for goods and services sold or purchased online. In payment fraud, fraudsters will buy your product published on social media platforms. After that, they will want to pay it via Cash App and send an email confirming the payment to your account.

But once you’ve checked your account, there won’t be a dime on it for the goods sold. It’s impossible to prove that he didn’t pay you because he’ll say you’re trying to cheat him and ask for a refund.

7. Fake security alerts claiming your Cash App account has been compromised.

Many fraudsters try to manipulate users, instill fear in them, and it works. In the case of fear, the fraudsters intimidate the victim with reports that a data leak has compromised her account. The message will include a link or attachment to which you want to change your credentials to log into the Cash App. Thus, by switching to a fake site, the user risks losing the data that will be entered. After that, his account will be controlled by the scammers.

8. Receiving fake cash app debit cards through the mail

Cash App provides its users with debit cards to access their funds. But the fraudsters also started sending the same cards by mail, with instructions for downloading the application to your device and its configuration. So, when a user uploads this to their device, they log into their account and thus allow scammers to steal this information because the app is fake.

After you fund your account, fraudsters can easily withdraw this amount as they will have all your credentials.

9. Scammers requesting gift cards in return for “free money” on Cash App

Gift cards are popular among scam artists. They use fictitious cash sweepstakes to send people a gift card. This lets the scammer stay anonymous and impossible to track. There are times when scammers will pretend to be from the FBI or the IRS and will threaten you with imprisonment or large fines if you don’t send them gift cards.

The Federal Trade Commission estimates that $148 million worth of goods and services are fraudulently paid for with gift cards. This is the number one scamming method among consumers.

10. Romance scams on Cash App

Romance scams are caused by fake accounts created on social media and dating websites. In these scams, fraudsters build relationships with victims.

Criminals use trust as a tool for their scams. They invent some emergency and request funds, wire transfers, or other untraceable means. They might say they’re trapped overseas without access to their account or have legal trouble. None of it is accurate, and sending funds to them will result in them melting away.

How To Avoid and Prevent Cash App Scams

- Don’t disclose sensitive information. Never disclose personal information such as passwords, PINs, authentication codes, or SSNs on Cash App. Additionally, do not share your bank account information or sensitive information. Cash App employees will never request this information.

- Use two-factor authentication (2FA) on your account. The Cash App allows users to secure their accounts with two-factor authentication. The method requires users to input a special code provided by an authenticator app instead of a text message.

- Set up “security lock” and payment notifications. Using the Cash App’s “Security Lock,” users must input a passcode for each payment. You can additionally set up email and text message notifications for each payment made to ensure you aren’t left in the dark.

- Secure your mobile devices against scammers. Create unique secure passcodes and secure biometric options such as fingerprint identification on all your mobile devices. An appropriate example is a password for your phone that should not be the same as the one for your computer or iPad.

- Log out of the Cash App when you’re not using it. Anyone who uses your device can easily access your account if you keep it logged in.

- Beware of links and attachments in emails or messages. Hackers frequently exploit this security hole to infect your devices with malware. The best security posture requires keeping your device up-to-date with optimal antivirus software installed.

- Don’t keep large sums of money in your account. Only hold small amounts of money in your Cash App balance. This balance isn’t federally insured.

- Avoid sending money to people you don’t know. Before sending money to someone who is not a family member or friend, verify their account details.

- Only contact customer support by using the actual app. Any messages claiming to be from the Cash App should be ignored. If a person on the phone claims to be from Cash App, disconnect the call or ignore the message. Instead, contact the company through the app.