Internet fraud is becoming increasingly widespread and sophisticated. From simple phishing to romantic scammers, fraudsters are always looking for and inventing new ways to deceive unsuspecting victims. Let’s talk about the ways to understand that you’ve fallen victim to a scam, or are close to becoming one. It’s important to remember that it’s crucial to stay vigilant and not lose your head over incredible offers.

Uncertain account activity

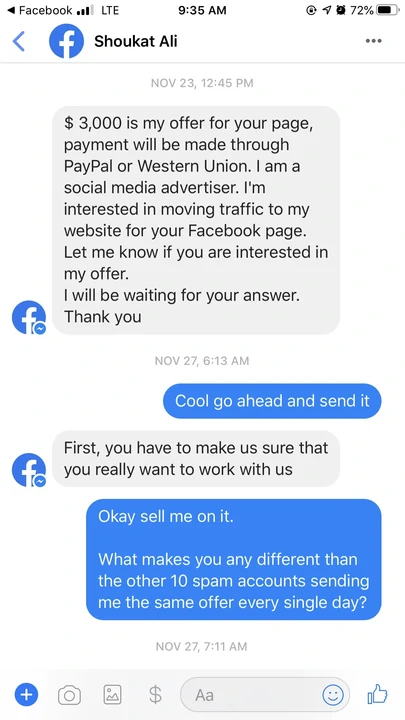

Scammers can get your credentials through phishing emails or scams that trick you into revealing your password. This can happen with social media accounts, email accounts, ride-hailing and food ordering apps, and even streaming services like Netflix. In addition to personal information, they can also access any stored credit card information associated with the account.

The most common sign here is seeing numerous messages and posts made, from your name without your will. In most cases, hackers who have possessed your account will try to conceal the crime by deleting the messages locally. However, not all messengers and social media support such a trick; publications are not possible to delete locally at all. Some of the side effects, like stealing personal data and banking info, may appear long after the initial case.

Problems with wire out transactions on investment platforms

One day, you may uncover that it is impossible to withdraw money from crypto investments. Investment fraud has been a major source of income for fraudsters, especially in the cryptocurrency market. They can create fake investment opportunities, promise high returns and convince victims to invest. However, when it comes time to withdraw their earnings, they may find that their account is frozen, their funds are gone, or the investment itself was fake from the start. This type of fraud can be difficult to recover from because cryptocurrencies are often unregulated and transactions are irreversible.

Scammers can create companies with convincing names and makeup success stories to make people believe that their product/scheme works. Sometimes they may even use well-known people in the cryptocurrency industry to further convince their victims. However, everything becomes clear at the moment when you try to get your money back. It is the clearest, and probably the most widespread symptom of investment scams. Sure, sometimes even legit companies have financial troubles and cannot fulfill all the wire-out requests of their clients. But you’d likely be warned if that is the case.

The inability to withdraw money for you may be served for different reasons. Softer cases imply offering you to hold on and take part in a very profitable deal you should not miss. Harder, however, may sometimes come up with asking you to prove your identity once again, prove that you are the real owner of the account, et cetera. Over these “security check-ups”, they will most definitely find something unmatching, that is enough to refuse the withdrawal.

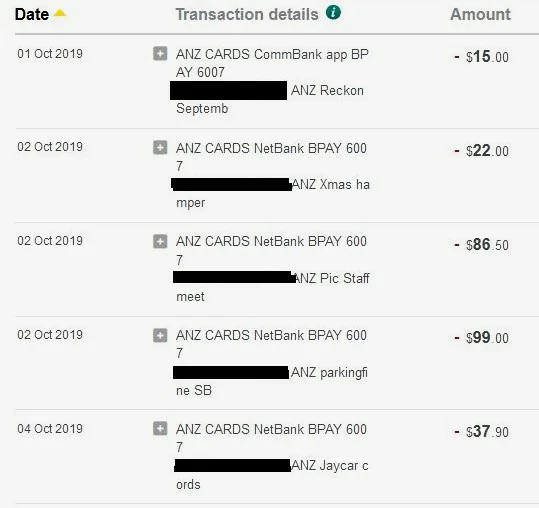

Strange banking transactions

If fraudsters have your data and/or financial details, they can use them to commit payment scams – where stolen card details and/or cards stored in hijacked accounts are used without your knowledge. Alternatively, they may use your personal information to obtain new credit cards.

Fraudsters can also use stolen data to apply for a loan in their own name, but with the victim’s bank details. For example, a fraudster may use their own social security number or other personal details, but provide the victim’s address and account information. Not all banks may suspect this as fraud and therefore approve such a loan, transferring the funds to the fraudster’s account. Additionally, not all financial institutions require personal information such as address and name, and all they need are bank details.

The first sign that something is wrong with your bank account can be noticed by strange activity on the account, including “strange” debits. If the problem is with Automatic Payments (NAF), it may be more difficult to notice until you receive a letter or email notifying you of late payments.

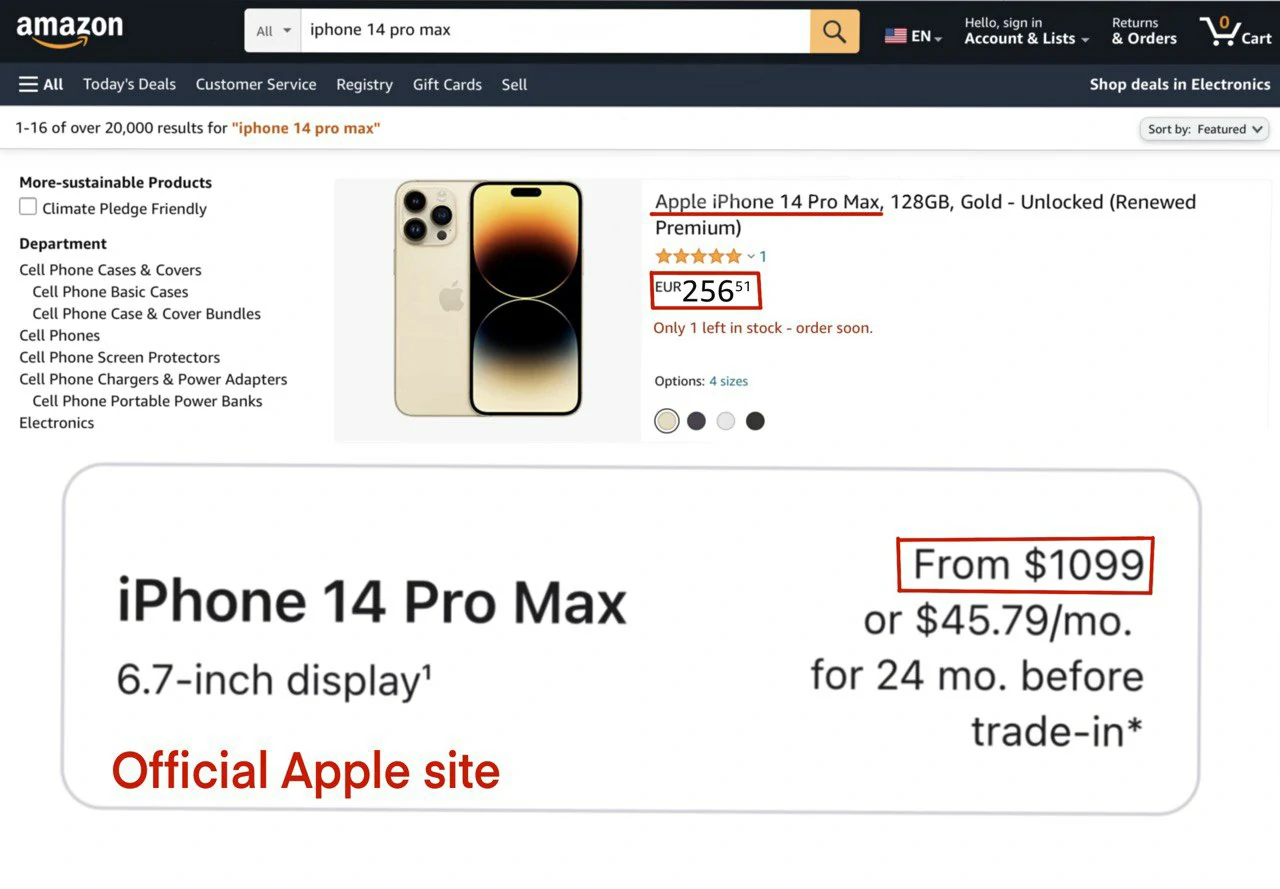

Product that was not shipped

Internet fraud is a growing problem. Scammers often try to sell expensive goods online, usually at greatly reduced prices, in order to attract buyers. They create websites or social media accounts that offer products at fairly low prices, such as electronics, household appliances, branded clothing, jewelry, etc. It is the low price that appeals to potential victims.

When a buyer is ready to make a purchase, scammers typically assure them that the item is available, but payment must be made through instant payment apps such as Zelle, Venmo, and Cash App. These apps do not offer buyer protection, so once the money is transferred, it cannot be refunded.

After the payment is made, scammers either disappear and do not ship the item, or demand more money by inventing various reasons. For example, they may claim they accidentally provided the wrong payment details or that additional payment is required for shipping/insurance. If the buyer refuses to pay, scammers may begin to blackmail them by threatening to disclose their personal information, leaving the victim feeling trapped.

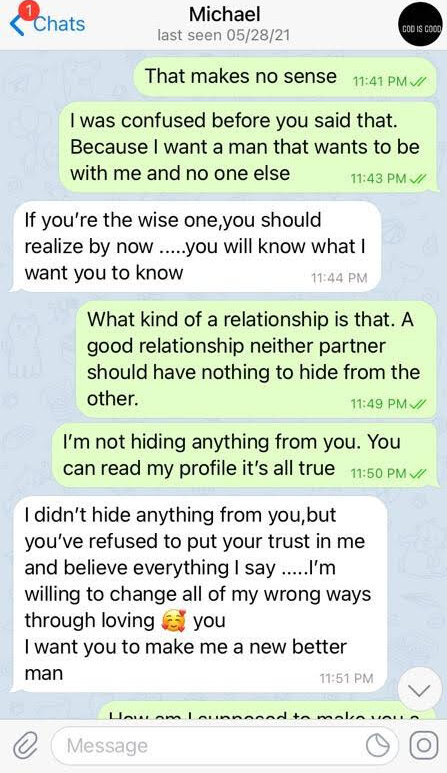

From love to fraud

A romance scam sounds better than it is. Unfortunately, in today’s world, fraudsters are ready for anything to extort money from a person. This is the type of scam that preys on people looking for love and communication online. At first, fraudsters create believable profiles on social networks or in special applications such as Tinder. They may spend weeks or even months building a relationship with the victim, sharing personal information, and creating a sense of trust and intimacy.

When the fraudster is sure that the victim is in love with him, he starts asking for small amounts at first. For example, top up a mobile phone account or pay a small fine. Then the amounts can grow, and the “reasons” to send money are more serious. For example, to treat a terrible illness of the mother, or to pay out loans.

Unfortunately, as soon as the victim sends the money, the scammer can disappear immediately. But in some cases, they may continue to contact the victim and demand more and more money, using threats or emotional manipulation to keep them on the hook.